Motorcycle Financing: Smart Move or Costly Mistake?

Motorcycle financing: smart move or costly mistake?

The allure of the open road, wind in your face, and the distinctive rumble of an engine beneath you make motorcycles an enticing purchase for many riders. But when the price tag exceeds what’s in your bank account, financing become a consideration. Should you finance a motorcycle, or is it better to save up and pay cash? This comprehensive guide explore the factors to consider before sign on that dotted line.

Understand motorcycle financing options

Motorcycle financing work likewise to auto loans, but with some key differences that can importantly impact your financial health.

Dealership financing

Most motorcycle dealerships offer in house financing options, oftentimes through partnerships with banks or credit unions. These loans typically range from 24 to 84 months, with interest rates vary base on your credit score, down payment, and the loan term.

Dealership financing offer convenience — you can ride house on your new bike the same day — but this convenience oftentimes come at a premium. Dealers may mark up interest rates above what you might qualify for elsewhere, add to your overall cost.

Bank and credit union loans

Traditional financial institutions offer motorcycle loans with potentially lower interest rates than dealerships, particularly if you have an exist relationship with the bank. Credit unions, in particular, oftentimes provide the nearly competitive rates for vehicle loans.

The downside? The process take longsighted, will require pre-approval before shopping, and you will need to will handle the paperwork between the lender and dealer.

Online lenders

Numerous online lenders specialize in motorcycle financing. These platforms oftentimes provide quick approval processes and competitive rates. Nonetheless, not all online lenders are created equal, and some may charge higher rates or fees to compensate for their lenient approval requirements.

Manufacturer financing

Major motorcycle manufacturers like Harley-Davidson, Honda, and Yamaha offer financing programs, sometimes with promotional rates amp low as 0 % Apr for qualified buyers. These promotions can provide substantial savings but typically require excellent credit and may be available exclusively on specific models or during certain times of the year.

The cost of finance a motorcycle

Before decide to finance, understand the true cost beyond the sticker price.

Source: Nazi grip.com

Interest rates and how they impact total cost

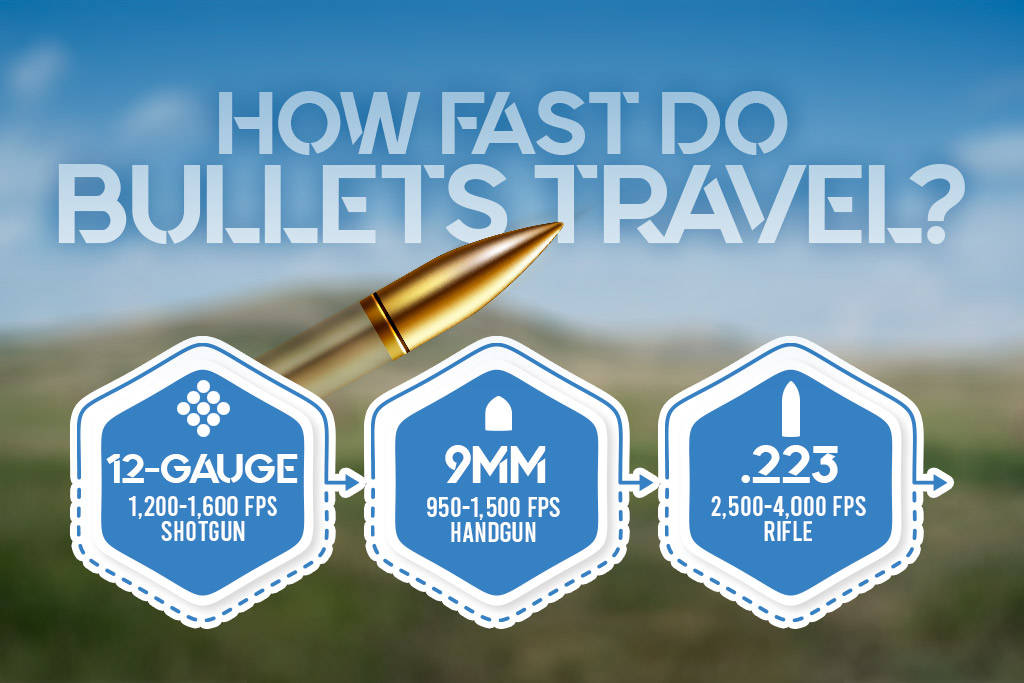

Motorcycle loan interest rates typically range from 4 % to 15 % depend on your credit score, loan term, and the lender. Still an apparently small difference in interest rate can importantly impact your total cost.

For example, on a $15,000 motorcycle with a 660-monthloan:

- At 5 % interest: monthly payment of $283, with total interest pay of $$1980

- At 10 % interest: monthly payment of $318, with total interest pay of $$4080

That 5 % difference results in pay an additional $2,100 for the same motorcycle.

Loan terms: shorter vs. Longsighted finance

While longer loan terms reduce your monthly payment, they increase the total interest pay and extend the period you’re underwater on the loan (owe more than the bike is worth )

Motorcycles typically depreciate immobile than cars, lose 20 30 % of their value in the first year and roughly 10 % yearly after that. With a long term loan, you could find yourself owe thousands more than your motorcycle is worth for several years.

Down payments: minimizing financial risk

A substantial down payment (20 % or more )provide several benefits:

- Lower monthly payments

- Reduced interest costs

- Decreased risk of negative equity

- Potentially better loan terms

Without a down payment, you will start underwater on your loan instantly, as the motorcycle’s value will drop below what you’ll owe ampere shortly as you ride off the lot.

Additional costs beyond the loan

The purchase price and interest aren’t your only expenses. Factor in:

-

Insurance:

Lenders require comprehensive coverage on finance motorcycles, which cost importantly more than basic liability insurance -

Taxes and fees:

Sales tax, registration, title fees, and documentation fees can add 10 % or more to the purchase price -

Gear:

Quality helmet, jacket, gloves, and boots can easily cos$1 1,000 + -

Maintenance:

Regular service, tires, and repairs

When finance a motorcycle make sense

Despite the costs, financing can be a reasonable option in certain circumstances.

Strong credit score and favorable terms

If your credit score exceeds 720, you’ll potential will qualify for the best interest rates. Combine with a substantial down payment and a loan term of 36 months or less, financing might not importantly increase your total cost.

Special manufacturer incentives

When manufacturers offer really low interest promotions (under 3 % ) the cost of financing become minimal. These offers typically appear during model year transitions or slow sales periods.

When time value of money works in your favor

If you have the cash but could invest it for a higher return than your loan’s interest rate, financing might make mathematical sense. For example, if you qualify for a 4 % motorcycle loan but can moderately expect 7 % returns from investments, the differencrepresentsnt potential profit.

Nonetheless, this approach involves risk and require discipline investing of the funds you’d have use for the purchase.

Emergency fund preservation

If purchase a motorcycle unlimited would deplete your emergency fund, finance with a manageable monthly payment might be the more prudent choice. Financial experts recommend maintain 3 6 months of expenses in an emergency fund before make large cash purchases.

When you should avoid finance a motorcycle

Several scenarios should give you pause before sign a motorcycle loan agreement.

Poor or fair credit scores

With a credit score below 660, you’ll probably will face interest rates of 10 % or higher. At these rates, financing become exceedingly expensive, potentially add 20 30 % to the motorcycle’s cost.

Stretch your budget

If the only way to afford the monthly payment is with a 72 month or 84-month loan, your probable purchase more motorcycle than you can afford. Remember that the motorcycle itself represent exclusively part of the ownership cost.

Already carry significant debt

If you’re work to pay down credit cards, student loans, or other high interest debt, add a motorcycle loan works against your financial goals. The interest you’re pay on exist debt probably exceed any enjoyment from a new motorcycle.

Source: blog.chopperexchange.com

Unstable income or employment

Motorcycles are discretionary purchases. If your income fluctuate or your job security is questionable, commit to years of payments create unnecessary financial stress.

Alternatives to traditional financing

Before commit to a multi-year loan, consider these alternatives.

Save and pay cash

The financially optimal approach is safe until you can purchase unlimited. This method:

- Eliminates interest costs

- Provide negotiate leverage with dealers

- Allow for less expensive insurance options

- Create a sustainable pattern for future purchases

While delay gratification isn’t exciting, the financial benefits are substantial.

Purchase use rather of new

A two or three-year-old motorcycle typically cost 30 40 % less than its new counterpart while offer near identical performance and features. This approach allow you to either:

- Purchase a higher end model for the same budget

- Reduce or eliminate the need for financing

- Minimize depreciation losses

Many riders find that buying use provide the best value, specially for first time owners.

Motorcycle leasing

Though less common than auto leasing, motorcycle leases offer lower monthly payments and the ability to ride a new bike every few years. Notwithstanding, leases come with mileage restrictions, wear and tear penalties, and no ownership equity at the end of the term.

Leasing make the most sense for riders who:

- Prefer have the latest models

- Ride comparatively few miles yearly

- Take excellent care of their motorcycles

- Don’t plan to customize their bikes

Peer to peer lending

Platforms like prosper and lending club connect borrowers with individual investors, sometimes offer more favorable terms than traditional lenders, peculiarly for borrowers with unique financial situations.

Make the decision: a practical framework

To determine if financing is right for your situation, consider this decision framework.

The 20/4/10 rule adapted for motorcycles

Financial advisors frequently recommend the 20/4/10 rule for auto purchases:

- 20 % minimum down payment

- 4-year maximum loan term

- 10 % maximum of monthly income toward all vehicle payments and related expenses

For motorcycles, consider adapt this to the 20/3/5 rule:

- 20 % minimum down payment

- 3-year maximum loan term (due to faster depreciation )

- 5 % maximum of monthly income toward motorcycle payment and expenses (since motorcycles are typically secondary vehicles )

Total cost of ownership calculation

Before financing, calculate your true five-year cost of ownership:

- Purchase price + interest + fees

- Insurance premiums for 5 years

- Expect maintenance and repairs

- Gear replacement

- Fuel costs base on expected mileage

- Minus expect resale value

This calculation much reveals that the loan payment represent solely a portion of the actual cost of motorcycle ownership.

Opportunity cost consideration

Consider what else you could do with the money spend on motorcycle payments and interest. Would invest that money yield greater long term benefits? Could it fund other experiences or goals that might provide more lasting satisfaction?

Negotiate the best financing terms

If you decide financing is appropriate for your situation, use these strategies to secure the virtually favorable terms.

Get pre-approved before shopping

Secure financing approval from a bank or credit union before visit dealerships provide several advantages:

- Knowledge of your budget and interest rate

- Leverage to negotiate better dealer financing

- Protection from high pressure financing tactics

- Focus on the motorcycle kinda than payment terms

Negotiate the purchase price, not the payment

Dealers oftentimes focus on monthly payments kinda than the motorcycle’s price. This tactic allows them to hide higher interest rates or extend terms that increase your total cost.

Invariably negotiate the motorcycle’s price 1st, so discuss financing individually. This approach prevent dealers from offset a price discount with less favorable loan terms.

Read the fine print

Before signing, cautiously review the loan agreement for:

- Prepayment penalties

- Mandatory arbitration clauses

- Add on products (extend warranties, gap insurance )that may bebe overpriced

- Variable interest rates that could increase over time

Consider refinancing options

If you accept dealer financing to take advantage of rebates or promotions, investigate refinance options after purchase. Many credit unions offer motorcycle loan refinancing that could lower your rate after the initial dealer incentives.

Make your final decision

After weigh all factors, your decision should reflect both financial wisdom and personal priorities.

Balance financial prudence with riding enjoyment

While the financially optimal choice is commonly safe and pay cash for a use motorcycle, personal factors matter besides. If motorcycling represent a significant passion or lifestyle element, reasonable financing might be worth the additional cost — provide it doesn’t jeopardize your broader financial health.

Consider your riding experience level

New riders should be especially cautious about finance expensive motorcycles. With a 30 40 % drop out rate among new riders within the first year, finance a premium motorcycle before confirm your long term interest create significant financial risk.

Plan for the complete ownership cycle

Your financing decision should account for the entire ownership period, include:

- How yearn you plan to keep the motorcycle

- Expect maintenance costs as the bike age

- Potential resale timing and value

This forward moving think approach help prevent unpleasant financial surprises previous in the ownership cycle.

Conclusion: is motorcycle financing right for you?

Finance a motorcycle can be appropriate under the right circumstances: strong credit, reasonable loan terms, adequate down payment, and stable financial situation. Yet, for many riders, save for a cash purchase — especially of a quality use motorcycle — represent the more financially sound decision.

Remember that the joy of motorcycling come from the ride itself, not inevitably from have the newest or virtually expensive model. The virtually satisfying motorcycle ownership experience come when the financial aspects of ownership enhance kinda than detract from your riding enjoyment.

By cautiously consider your financial situation, research all options, and make a decision align with your broader financial goals, you can find the right balance between motorcycle passion and financial responsibility.

MORE FROM getscholarships.net