Personal Finance Education: Math Skills vs. Life Skills

The relationship between personal finance and mathematics

Whether personal finance is a math class touch on an important educational debate. While personal finance education sure involve mathematical concepts, it encompasses practically more than just calculations and formulas. Let’s explore this relationship to understand how these subjects overlap and differ.

Personal finance education teach students how to manage money efficaciously, make informed financial decisions, and plan for future financial security. Mathematics provide essential tools for these skills, but personal finance extend beyond pure math into psychology, economics, and practical life skills.

Mathematical components of personal finance

Several mathematical concepts form the foundation of personal finance education:

Basic arithmetic

Addition, subtraction, multiplication, and division are fundamental to budgeting, tracking expenses, and calculate savings. These operations help individuals understand cash flow and maintain financial balance.

Percentages

Understand percentages is crucial for comprehend interest rates, calculate discounts, determine tax obligations, and evaluate investment returns. This concept appears throughout personal finance applications.

Compound interest

Peradventure one of the virtually powerful mathematical concepts in personal finance, compound interest demonstrate how money grow over time. This mathematical principle underpin investing, saving, and debt management strategies.

For example, calculate how a $1,000 investment might grow at 7 % annual interest over 30 years require apply the compound interest formula: a = p(1 + r )

T

, where a represent the final amount, p is the principal, r is the interest rate, and t is time.

Algebra

Algebraic thinking help individuals solve for unknown variables in financial equations. This applies when determine how much to save monthly to reach a specific goal, calculate loan payments, or solve breafiftyty points for financial decisions.

Probability and statistics

Risk assessment and management rely on understand probability and statistics. These concepts help individuals evaluate insurance options, investment risks, and the likelihood of various financial outcomes.

Beyond mathematics: the full scope of personal finance

While math provide essential tools, personal finance education extend comfortably beyond mathematical concepts:

Behavioral economics

Understand psychological factors that influence financial decisions is crucial. Concepts like loss aversion, present bias, and mental accounting explain why people don’t invariably make mathematically optimal choices with money.

Consumer rights and responsibilities

Personal finance education teach students about financial regulations, consumer protections, and their rights when deal with financial institutions. This knowledge help prevent exploitation and ensure fair treatment in the financial marketplace.

Financial products and services

Students learn about various financial products include bank accounts, credit cards, loans, insurance policies, and investment vehicles. Understand these options require more than mathematical analysis — it involve compare features, benefits, and potential drawbacks.

Financial values and goal set

Effective personal finance education help individuals clarify their values and set meaningful financial goals. This process involve self reflection and priority setting that go beyond numerical calculations.

Economic literacy

Understand broader economic concepts like inflation, recession, market cycles, and monetary policy help individuals contextualize their personal financial decisions within the larger economy.

How schools approach personal finance education

Educational institutions take various approaches to teach personal finance:

Standalone personal finance courses

Some schools offer dedicated personal finance courses that cover comprehensive money management topics. These courses oftentimes incorporate mathematical concepts but focus on practical application preferably than abstract theory.

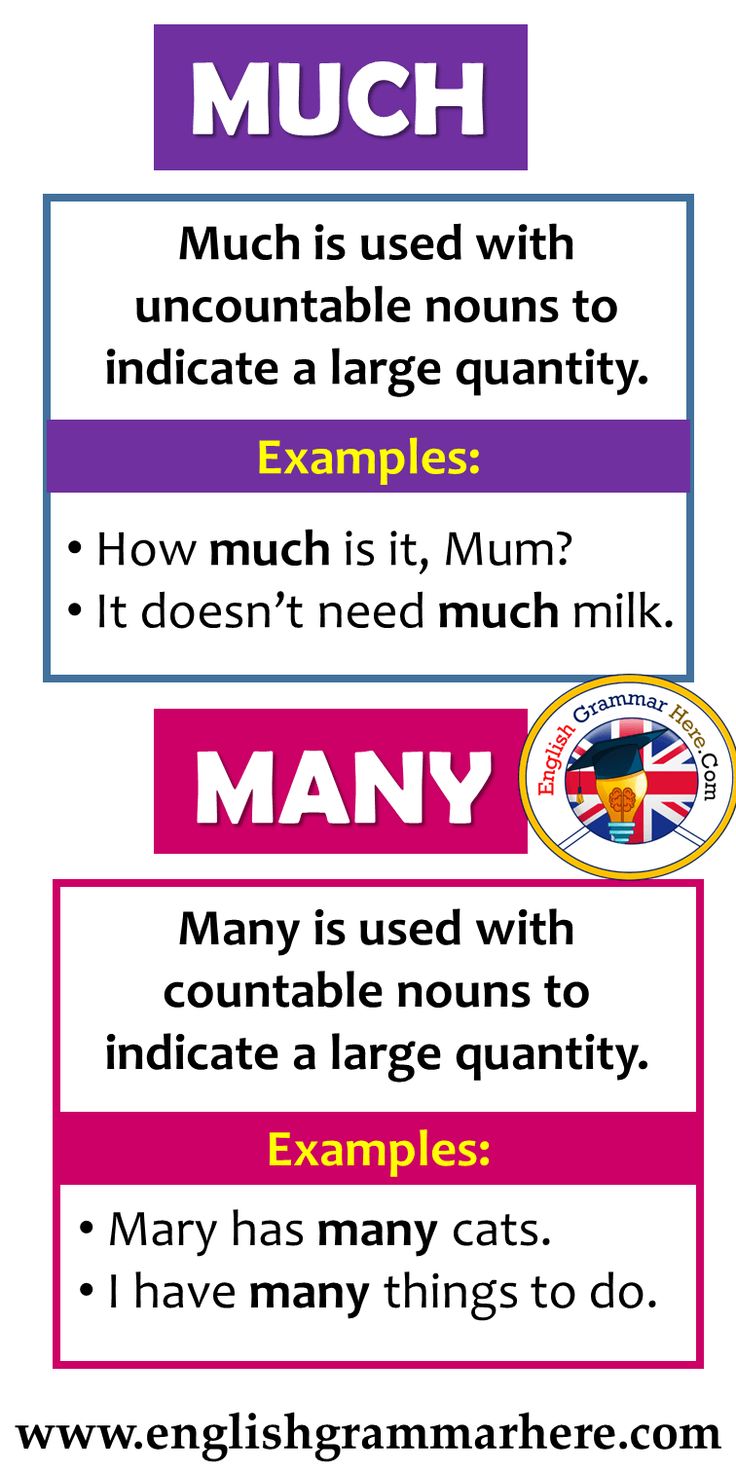

Integration with mathematics

Many schools incorporate personal finance examples into mathematics classes. This approach help students see the real world relevance of mathematical concepts while build financial literacy.

For instance, a lesson on exponential functions might use compound interest examples, or a unit on percentages could focus on calculate sales tax, discounts, and tips.

Cross curricular approaches

Some schools distribute personal finance education across multiple subjects. While math classes might cover the calculations, social studies might address economic systems, and family consumer science could focus on budgeting and consumer decision-making.

The case for separate personal finance from math

Several arguments support treat personal finance as distinct from mathematics education:

Accessibility for math anxious students

Many people experience math anxiety but lull need financial literacy. Present personal finance mainly as a math subject might discourage these individuals from engage with essential money management concepts.

Emphasis on decision-making

While mathematical calculations inform financial decisions, many factors beyond numbers influence these choices. Personal finance education should emphasize judgment, values clarification, and decision make processes that extend beyond mathematical optimization.

Practical application vs. Theory

Mathematics education frequently emphasizes theoretical understanding and procedural fluency. Personal finance education prioritize practical application and real worldproblem-solvingg. These different emphases suggest different pedagogical approaches.

Comprehensive coverage

Treat personal finance exclusively as a mathematical topic risks neglect important non-mathematical aspects like consumer rights, financial psychology, and economic literacy.

The case for integrating personal finance with math

Conversely, there be compelling reasons to connect personal finance education with mathematics:

Real world context for mathematical concepts

Personal finance provide meaningful contexts that demonstrate the relevance of mathematical concepts. This connection can increase student engagement and motivation in mathematics.

Reinforcement of mathematical skills

Apply mathematics to personal finance problems reinforce mathematical skills through authentic practice. Students see how mathematical tools will solve real problems they’ll encounter throughout life.

Efficiency in curriculum

In crowded school schedules, integrate personal finance with mathematics allow schools to address both subjects simultaneously, ensure financial literacy isn’t overlooked.

Quantitative foundation

While personal finance isn’t solely mathematical, strong quantitative skills provide a foundation for good financial decision-making. Connect these subjects emphasize this important relationship.

Effective approaches to teach personal finance

Disregarding of whether personal finance is taught as part of mathematics or as a separate subject, certain approaches enhance its effectiveness:

Project based learning

Hands-on projects like create and maintain a budget, research investment options, or plan for a major purchase help students apply financial concepts in realistic contexts.

Simulation and role playing

Financial simulations allow students to practice decision-making in low stakes environments. Stock market games, budget challenges, and business simulations develop both mathematical skills and financial judgment.

Source: ckmath.net

Technology integration

Financial calculators, spreadsheets, and personal finance apps help students understand complex calculations while focus on decision-making preferably than computational procedures.

Real world examples

Use authentic financial documents like bank statements, credit card offers, loan applications, and investment prospectuses make learn relevant and prepare students for actual financial situations.

Essential financial math skills everyone should learn

Whether teach in mathematics class or elsewhere, certain mathematical skills are essential for financial literacy:

Calculate interest

Understand how to calculate both simple and compound interest help individuals evaluate savings options, understand debt costs, and appreciate the power of long term investing.

Computing loan payments

The ability to calculate monthly payments for mortgages, auto loans, and other financing help consumers make inform borrowing decisions and understand the true cost of purchases.

Analyze risk and return

Basic statistical concepts help individuals evaluate the relationship between risk and potential return in investments, insurance decisions, and other financial choices.

Tax calculations

Understand how to calculate income tax, sales tax, property tax, and other tax obligations help individuals plan efficaciously and avoid financial surprises.

Budgeting and cash flow analysis

The ability to track income and expenses, calculate savings rates, and project future cash flows enable effective financial planning and management.

Find balance: the ideal approach to personal finance education

The virtually effective approach to personal finance education potential combine mathematical rigor with broader financial concepts:

Strong mathematical foundation

Students need solid mathematical skills to perform financial calculations accurately. Mathematics education should highlight financial applications of key concepts.

Comprehensive financial literacy

Beyond calculations, students need to understand financial systems, products, consumer protections, and economic concepts that provide context for their personal financial decisions.

Psychological awareness

Effective financial education acknowledge the psychological and emotional aspects of money management, teach strategies to overcome common behavioral biases.

Practical application

Irrespective of where personal finance is taught, it should emphasize real world application through authentic problems, current examples, and practical exercises.

Conclusion: more than precisely math

Personal finance education incorporate mathematical concepts but extend comfortably beyond a traditional math class. While calculations and formulas provide essential tools for financial decision make, effective money management besides require understand economic systems, consumer rights, psychological factors, and personal values.

The ideal approach recognizes the mathematical foundation of personal finance while acknowledge its broader scope. Whether teach as a standalone course or integrate across the curriculum, personal finance education should prepare students to make inform, responsible financial decisions throughout their lives.

By combine mathematical rigor with practical application and broader financial concepts, educators can develop financially literate individuals capable of navigate progressively complex financial landscapes with confidence and competence.

Source: overdrive.com

MORE FROM getscholarships.net