Does Snap Finance Report to Credit? Understanding Reporting, Credit Impact, and Access Pathways

Understanding Snap Finance: Lease-to-Own and Credit Reporting

Snap Finance is a prominent provider of

lease-to-own and installment loan financing

, serving millions of consumers since 2012. This service is often used by individuals with less-than-perfect credit or no credit history, allowing them to finance merchandise and services from thousands of partnered merchants. As lease-to-own financing grows more common, a key question emerges for consumers:

Does Snap Finance report to credit bureaus, and how does this affect your credit profile?

Does Snap Finance Report to the Major Credit Bureaus?

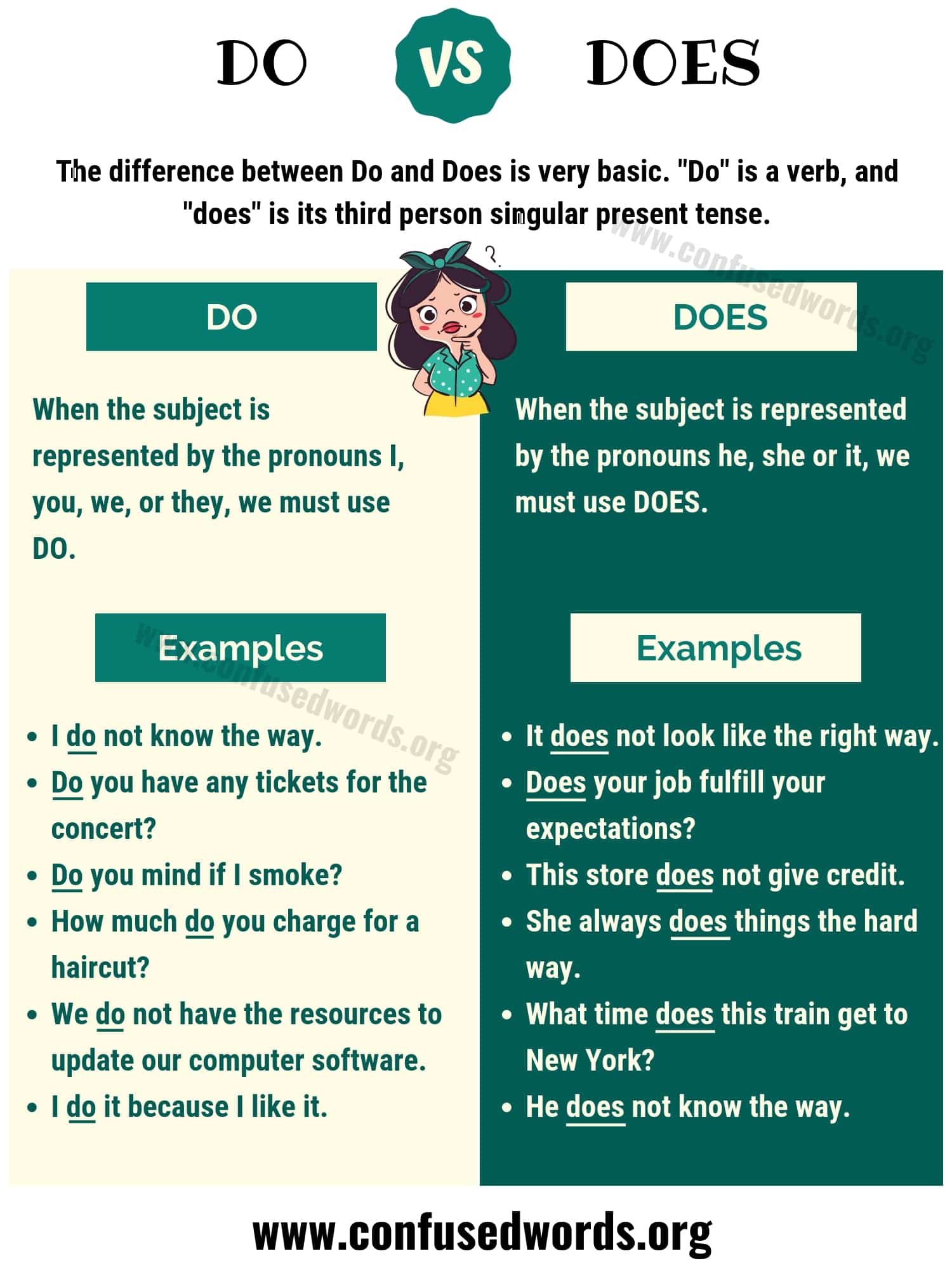

Snap Finance’s reporting practices are more nuanced than many traditional lenders. According to verified sources, Snap Finance does not report all customer activity to all three major credit bureaus (Equifax, Experian, TransUnion) . Instead, the company’s reporting depends on the type of product and the specific bureau involved:

- For lease-to-own products , Snap Finance reports payment outcomes to secondary credit reporting agencies, specifically Clarity Services Inc. and DataX [2] .

- For installment loan products , payment outcomes are reported to TransUnion as well as the secondary agencies [2] .

- Some sources indicate that Snap Finance may report payment history to Experian and, in certain cases, to TransUnion , but not to all three major bureaus consistently [1] .

This means that, while Snap Finance activity

may

appear on your credit report if you use their installment loan products, many lease-to-own agreements will only be visible to alternative (“secondary”) credit bureaus. Traditional credit scores (like FICO) often do not factor in information from these secondary bureaus.

Source: confusedwords.org

How Snap Finance Can Affect Your Credit

Understanding the impact of Snap Finance on your credit profile is essential for making informed borrowing decisions. Here’s what you need to know:

- Positive Payment History : Consistently making on-time payments on installment loans through Snap Finance can help build your credit profile with the bureaus Snap reports to, such as TransUnion or Experian [1] .

- Negative Payment Activity : Missed or late payments may be reported to the relevant bureaus and can negatively affect your credit score with those agencies. This is especially true for installment loan agreements [1] .

- Secondary Credit Bureaus : If your Snap Finance activity is only reported to Clarity Services or DataX, it may not directly impact mainstream credit scores, but could still affect your ability to access certain types of credit-especially with lenders who use these bureaus [2] .

-

Credit Checks

: Checking your eligibility for Snap Finance usually results in a

soft credit inquiry

, which does not affect your credit score. However, if you proceed with financing, Snap will obtain information from consumer reporting agencies, which may impact your score with those agencies [1] [2] .

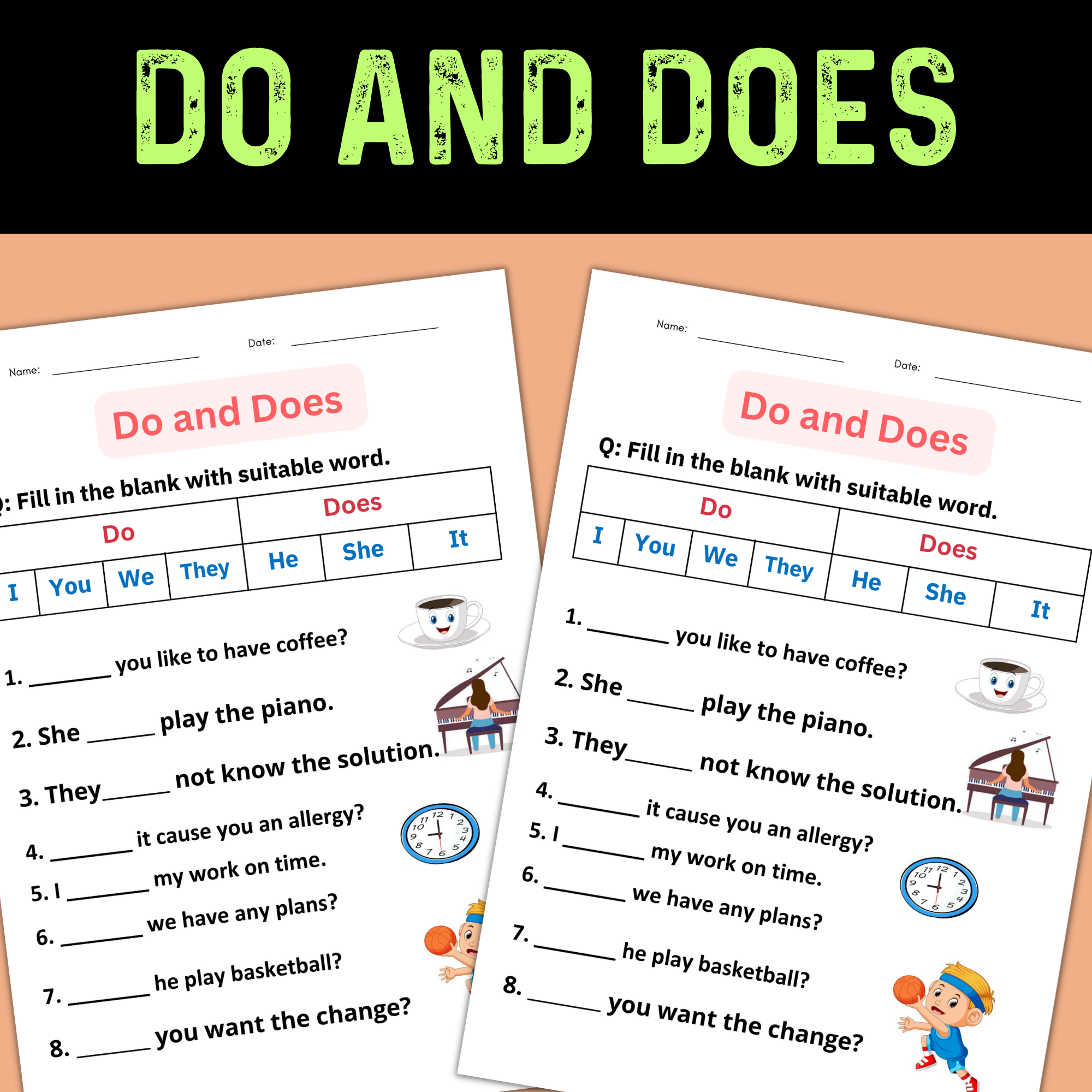

Step-by-Step Guide to Accessing Snap Finance Services

If you’re interested in using Snap Finance for lease-to-own or installment loan financing, follow these steps to get started:

- Review Eligibility Requirements: Snap Finance offers options for individuals with poor or no credit history. While no credit history is required, they will obtain data from consumer reporting agencies, including secondary bureaus [2] .

- Apply for Financing: You can apply for Snap Finance online through their official website or at participating partner merchants. The application process involves providing personal and financial information for assessment.

- Understand the Product Offered: Determine if you are being offered a lease-to-own agreement (typically reported only to secondary bureaus) or an installment loan (may be reported to TransUnion and others) [2] .

- Carefully Read All Disclosures: Review all terms, payment schedules, and reporting policies. Note that there have been regulatory concerns regarding the clarity and sufficiency of Snap Finance’s disclosures, so ask questions if anything is unclear [4] .

- Use Customer Support: If you have questions, contact Snap Finance’s customer care team at 877-557-3769 or email customer@snapfinance.com for assistance [2] .

- Monitor Your Credit: After obtaining financing, regularly check your credit reports with TransUnion, Experian, and secondary agencies (like Clarity Services and DataX) to ensure your information is accurate and up to date.

Potential Challenges and Consumer Protections

Snap Finance’s business practices have drawn scrutiny from regulatory agencies. In July 2023, the Consumer Financial Protection Bureau (CFPB) filed a lawsuit alleging that Snap Finance misled consumers about financing terms, failed to provide required disclosures, and engaged in improper servicing and collections practices [4] [2] . Key points for consumers include:

- Disclosure Issues: The CFPB alleges that Snap Finance failed to provide clear, required information about costs, finance charges, and annual percentage rates in some cases [4] .

- Debt Collection Practices: Allegations include misrepresenting payment obligations and making false threats during collections [4] .

- Reporting Accuracy: The CFPB also alleges Snap Finance failed to ensure the accuracy and integrity of consumer information furnished to credit reporting agencies [5] .

As a consumer, protect yourself by:

Source: pinterest.com

- Reading all agreements carefully and asking for clarification if needed

- Saving all communication and documentation related to your agreement

- Reporting any issues to the CFPB by visiting their official website and searching for the complaint portal

Alternative Approaches to Building Credit

If your goal is to build traditional credit history with the major bureaus, consider these alternative strategies:

- Secured Credit Cards: These require a cash deposit and are widely reported to all three major bureaus, helping you establish or rebuild credit.

- Credit Builder Loans: Offered by many credit unions and fintech firms, these are specifically designed to help you build credit with all major bureaus.

- Authorized User Status: Being added as an authorized user on someone else’s well-managed credit card can help you establish a positive credit history.

- Traditional Installment Loans: Personal loans from banks or credit unions are typically reported to all major bureaus.

Explore these options by contacting your local banks, credit unions, or searching for “credit builder products” from reputable fintech providers.

Frequently Asked Questions About Snap Finance and Credit Reporting

Does Snap Finance always report to credit bureaus? Snap Finance’s reporting varies by product. Installment loans may be reported to TransUnion and occasionally Experian, while lease-to-own agreements are generally reported to secondary bureaus [2] .

Can Snap Finance help me build credit? On-time payments on installment loans may help build credit with TransUnion or Experian. Lease-to-own agreements reported to Clarity Services and DataX may not impact traditional credit scores [1] .

Can Snap Finance hurt my credit? Missed or late payments can negatively impact your credit with any bureau Snap Finance reports to. Always make payments on time and monitor your credit reports for accuracy [1] .

How to Contact Snap Finance and Get Support

If you have questions or concerns about your Snap Finance agreement or credit reporting, you can:

- Call Snap Finance Customer Care at 877-557-3769

- Email customer@snapfinance.com

- Mail: P.O. Box 26561, Salt Lake City, Utah 84126

For complaints or unresolved issues, visit the Consumer Financial Protection Bureau website and search for their complaint submission portal.

References

- [1] Kudos (2025). Does Snap Finance Affect Your Credit Score? Explains reporting practices and credit impact.

- [2] Snap Finance (2023). Customer Help Center. Details on reporting to credit bureaus and contact information.

- [3] Katten (2023). CFPB action and regulatory analysis regarding Snap Finance.

- [4] CFPB (2023). CFPB Sues Snap Finance for Illegally Luring Americans.

- [5] CFPB (2023). Enforcement action against Snap Finance.

MORE FROM getscholarships.net