Understanding Loan Finance Charges: How to Calculate the True Cost of Borrowing

Understanding loan finance charges: how to calculate the true cost of borrowing

When take out a loan, the amount you borrow is exclusively part of the story. Finance charges represent the total cost of borrow money include interest and fees and understand them is crucial for make informed financial decisions.

Let’s explore how to calculate finance charges use a practical example: an $8,000 loan with monthly payments of $$16280 for 60 months.

What are finance charges?

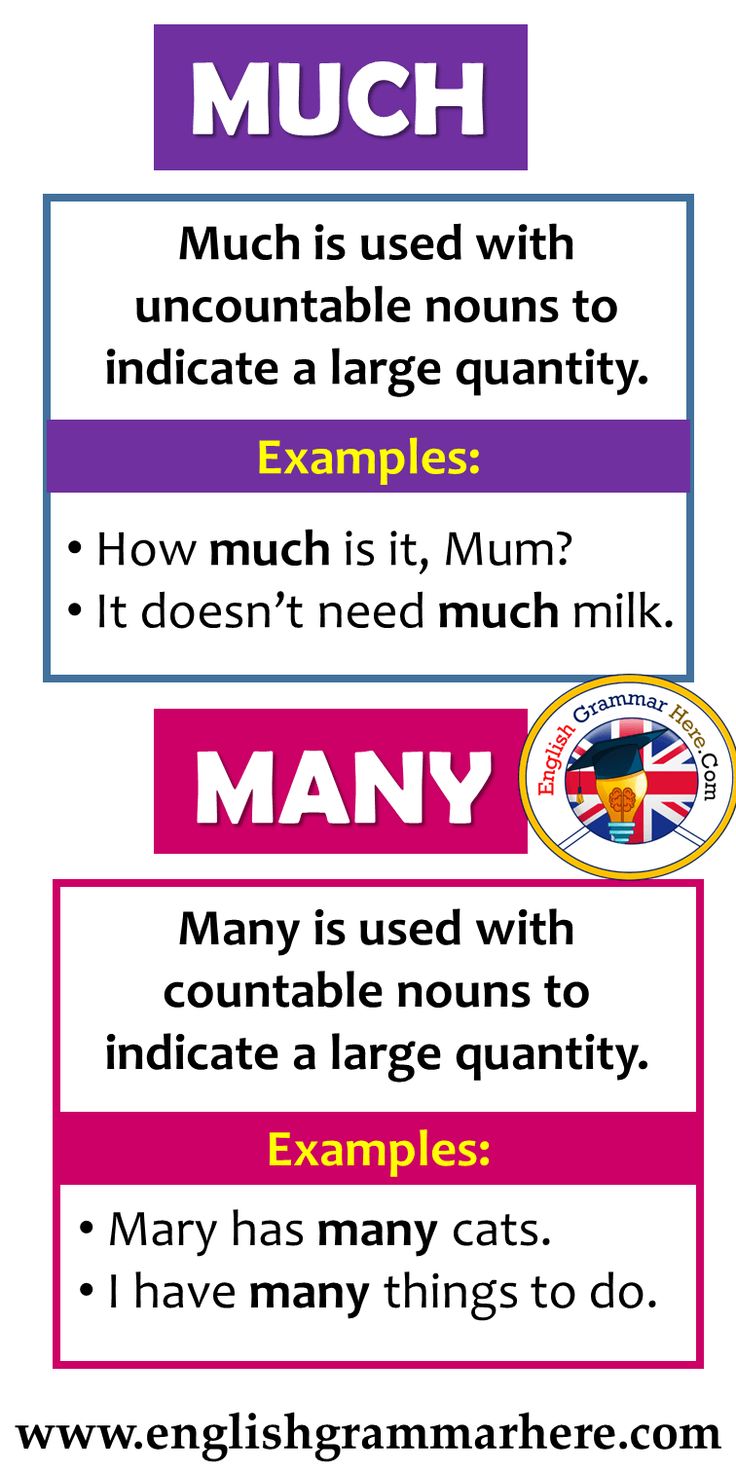

Finance charges represent the total cost of borrow money beyond the principal amount. These charges typically include:

- Interest payments

- Origination fees

- Service charges

- Late payment penalties

Understand the full finance charge help borrowers see the true cost of a loan beyond exactly the principal amount.

Calculate finance charges: the basic formula

The basic formula for calculate the finance charge is:

Finance charge = (monthly payment × number of payments ) incipal

Let’s apply this to our example:

- Principal (loan amount ) $ $800

- Monthly payment: $162.80

- Loan term: 60 months

1st, we calculate the total amount pay over the life of the loan:

Total amount pay = $162.80 × 60 = $$9768

So, we subtract the principal:

Finance charge = $9,768 8,000 = $ 1$18

This mean you’ll pay $1,768 in finance charges over the life of this loan, which is approximately 22.1 % of the original loan amount.

Understand annual percentage rate (aApr)

While know the total finance charge is helpful, understand the annual percentage rate (aApr)provide context about how expensive the loan is relative to other options.

For our example loan, we can approximate the Apr. With a finance charge of $1,768 on an $$8000 loan over 5 years, the approximate apAprould be around 8.5 %.

This is a simplified calculation. Lenders use more complex formulas that account for the decline balance as you make payments. Nonetheless, this approximation gives you a general idea of the loan’s cost.

Factors that affect finance charges

Interest rate

The interest rate is the primary factor determine your finance charges. Still a small difference in interest rate can importantly impact the total finance charge over the life of a loan.

For example, if our sample loan have an interest rate of 7 % alternatively of 8.5 %, the finance charge would be lower by several hundred dollars.

Loan term

The length of your loan direct affect the total finance charge. Longer terms typically result in higher total finance charges, yet though monthly payments may be lower.

If our example loan have a 36-month term rather of 60 months, the monthly payment would be higher, but the total finance charge would probably be lower.

Payment schedule

The frequency of payments can affect finance charges. Biweekly payment schedules, for instance, can reduce the total finance charge compare to monthly payments because you make more payments per year, reduce the principal fasting.

Additional fees

Many loans include origination fees, processing fees, or other charges that increase the total finance charge. When compare loans, ask for a complete breakdown of all fees.

Real world application: compare loan options

Let’s compare our original loan with some alternatives to see how finance charges differ:

Source: coursehero.com

Option 1: original loan

- Principal: $8,000

- Monthly payment: $162.80

- Term: 60 months

- Finance charge: $1,768

Option 2: shorter term loan

- Principal: $8,000

- Monthly payment: $248.40

- Term: 36 months

- Finance charge: $942.40

Option 3: lower interest rate loan

- Principal: $8,000

- Monthly payment: $152.67

- Term: 60 months

- Finance charge: $1,160.20

As you can see, option 2 (shorter term )have the lowest total finance charge but require higher monthly payments. Option 3 ( (wer interest rate ) )duce both the monthly payment and the finance charge compare to the original loan.

How to reduce finance charges

Improve your credit score

A higher credit score typically qualifies you for lower interest rates, which straightaway reduce finance charges. Before apply for a loan, take steps to improve your credit score:

- Pay bills on time

- Reduce credit card balances

- Avoid open new credit accounts

- Check your credit report for errors

Shop around for better rates

Different lenders offer different rates and terms. Obtain quotes from multiple lenders, include banks, credit unions, and online lenders. Yet a 1 % difference in interest rate can save hundreds on finance charges.

Consider a shorter loan term

If you can afford higher monthly payments, choose a shorter loan term typically result in lower total finance charges. This strategy work especially advantageously for auto loans and personal loans.

Make extra payments

Make additional payments toward the principal reduce the balance profligate, which mean less interest accrue over time. Before do this, confirm your loan doesn’t have prepayment penalties.

Refinance when appropriate

If interest rates drop or your credit improve importantly after take out a loan, refinancing could reduce your finance charges. Calculate the potential savings against any refinance costs to determine if this make financial sense.

Common misconceptions about finance charges

Misconception: the interest rate is the same as the Apr

The interest rate solely reflects the cost of borrow the principal. TheAprr include the interest rate plus other fees and costs express as a yearly rate, provide a more comprehensive view of the loan’s cost.

Misconception: all finance charges are disclosed upfront

While lenders must disclose certain finance charges, some fees might not be directly apparent. Incessantly read the fine print and ask for a complete breakdown of all potential charges.

Misconception: pay off a loan early invariably save money

While this is loosely true, some loans have prepayment penalties that can offset the savings from early payoff. Check your loan agreement for any prepayment terms.

Finance charges for different types of loans

Mortgages

Mortgage finance charges oftentimes include points, origination fees, and interest. Due to the long terms (typically 15 30 years ) the finance charges on mortgages can exceed the principal amount.

Source: YouTube.com

Auto loans

Auto loans typically have terms of 3 7 years. Dealership financing might include higher finance charges than loans obtain direct from banks or credit unions.

Personal loans

Personal loans, like our example $8,000 loan, commonly have terms of 1 7 years. The finance charges vary wide base on credit score, lender, and loan purpose.

Credit cards

Credit cards typically have the highest finance charges among common loan types, with interest rates oftentimes exceed 15 20 %. Make only minimum payments can result in finance charges that far exceed the original purchase amount.

Legal protections regard finance charges

Several laws protect consumers regard finance charges:

Truth in lending act (ttill)

This federal law require lenders to disclose the Apr, finance charges, and other loan terms before finalize the agreement. This transparency help borrowers compare loans and understand the true cost of borrowing.

State usury laws

Many states have laws limit the maximum interest rates lenders can charge. These laws provide protection against predatory lending practices.

Credit card act

This act provides specific protections for credit card users, include restrictions on interest rate increases and requirements for clear disclosure of terms.

Conclusion: make informed borrowing decisions

Understand finance charges empower you to make better borrowing decisions. For our example $8,000 loan with monthly payments of $$16280 for 60 months, the finance charge is $ $168 – a significant addition to the original loan amount.

Before take out any loan, calculate the total finance charge to understand the true cost of borrowing. Will compare different loan options, will consider not fair the monthly payment but to the total amount you’ll pay over the life of the loan.

By understand finance charges and implement strategies to reduce them, you can save money and achieve your financial goals more expeditiously. Whether you’re finance a car, consolidate debt, or make a major purchase, knowledge about finance charges put you in control of your financial future.

Remember that small differences in interest rates, loan terms, or payment strategies can lead to substantial differences in finance charges. Take the time to understand and compare these factors can save you thousands of dollars over the life of your loans.

MORE FROM getscholarships.net